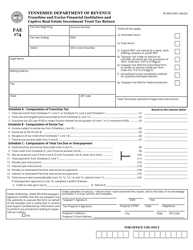

tn franchise and excise tax return

Download Instructions For Form Fae170 Rv R0011001 Franchise And Excise Tax Return Pdf 2020 Templateroller. The minimum tax is.

![]()

Tennessee Taxation Of Passthrough Entities

If applicable short period.

. The tax does not apply to a businesss income thats attributable to other states. A SMLLC is required to file a franchise excise tax return when 1 it is not disregarded for federal income tax purposes or 2 when it is disregarded for federal income. The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property.

FAE170 Franchise and Excise Tax Return. PC 559 amended Tenn. The excise tax rate is 65 of a businesss Tennessee taxable income.

Franchise Excise Tax - Franchise Tax Follow FT-2 - Franchise Tax Computation on a Final Return The franchise tax on a final return is computed using either. For tax years beginning on or after 1120 and ending on or before 123120. A taxpayer that standing alone is subject to the Tennessee franchise tax.

The excise tax is in. Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from. General Information Enter the beginning and ending dates of the period covered by this return.

Corporation subchapter S corporation limited liability company professional limited. What is the tax rate. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee.

Form FAE170 Returns Schedules and Instructions for Prior Years. All domestic entities in which the taxpayer directly or indirectly has more than 50 ownership. How To Make Your Tn Estimated Franchise And Excise.

Select Tennessee SMLLC Franchise Excise Tax Return from the left navigation menu. 67-4-2015h1A to lengthen the extension for filing Tennessee franchise and excise tax returns from six months to seven months for. Select the applicable Form CtrlT from dropdown menu.

The excise tax is 65. Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue. X close Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee.

Schedule C Schedule E rental Schedule. FE-9 - Extension for Filing the Franchise and Excise Tax Return To receive a six month extension a taxpayer must have paid on or before the original due date an amount. All entities doing business in Tennessee and having a substantial nexus in.

The following entity types may be required to file the franchise and excise tax return. For tax years beginning on or.

Accounting Articles Price Cpas Blog

2021 State Of Tennessee Tax Deadline Extension Brown Brown And Associates Cpa Tax Services For Clarksville Nashville And Springfield Tn

Form Fae Certhousing Certification Franchise And Excise Tax Exemption Limited Partnerships And Limited Liability Companies Providing Affordable Housing Fill In

Tennessee Rentals And The Fonce Exemption Mark J Kohler

![]()

Monthly Tennessee Tax Revenue Tracker For Fy 2020

Registering For Tennessee Taxes Using The Tennessee Taxpayer Access Point Tntap Youtube

What Taxes Are You Required To Pay In Tennessee Hispanic Entrepreneurs

Restauranteur Says Rep Hill Tax Forbearance Measure Would Be Welcome Wjhl Tri Cities News Weather

Tennessee Clarifies The Application Of Marketplace Facilitator Legislation To Franchise Excise Tax Forvis

Tennessee Franchise And Excise Tax Deadline Extended By Governor Lakeland Currents

Tennessee Franchise And Excise Tax Guide Pdf Free Download

Annual Tn Business Tax Seminar

Tennessee Cpa Journal Sept Oct 2018

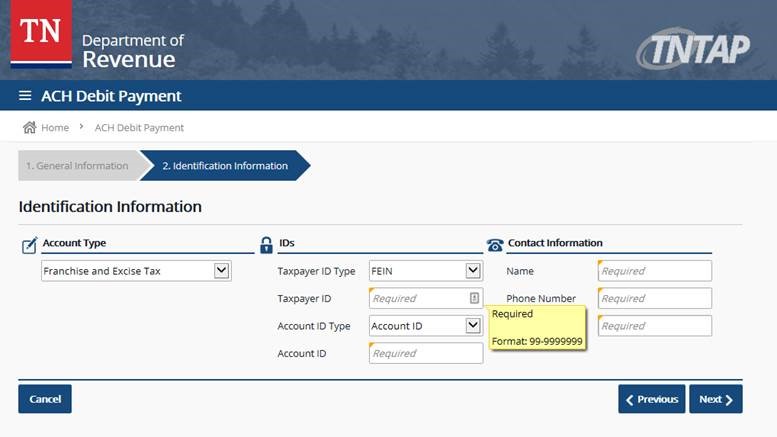

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tennessee Series Llc How To Start A Series Llc In Tennessee

Free Tennessee Tax Power Of Attorney Form Rv F0103801 Pdf Eforms

Form Fae174 Rv R0012001 Download Printable Pdf Or Fill Online Franchise And Excise Financial Institution And Captive Real Estate Investment Trust Tax Return Tennessee Templateroller

Tn Dept Of Revenue On Twitter Important Notice The Department Of Revenue Will Extend The Franchise And Excise Tax Filing And Payment Deadlines To May 16th 2022 For Those Located In A